Dealing with a defaulted student loan can be confusing, but you don’t have to figure it out alone.

In this article, we’ll explain what the collections restart means for you. You’ll also learn about options like loan rehabilitation and loan consolidation, and how you can avoid serious consequences. Plus, we’ll show you important things to watch out for before it’s too late.

Big Changes Are Coming for Defaulted Borrowers

The Department of Education made a big announcement in April 2025: starting May 5th, they will restart collections on defaulted federal student loans.

Collections have been paused since March 2020 to help borrowers during COVID-19. However, that break is ending soon, and payments will once again be expected. If you have student loan debt and are in default, this change affects you directly.

What This Means for You

If your loans are in default, a collections company is managing them now.

Your account entered default because you missed student loan payments for at least nine months. Now, your paycheck (and government assistance benefits!) is at risk of wage garnishment, and your tax returns are at risk of undergoing a tax offset. If you don’t want your tax return taken and applied to your loan balance instead of into your pocket, it’s best to get out of default immediately.

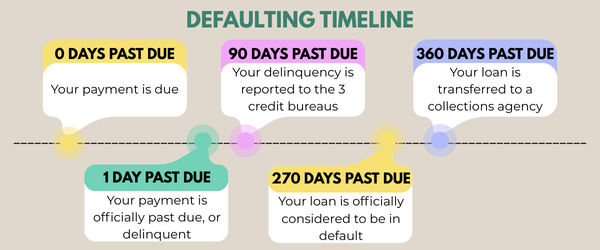

Let’s take a look below at the timeline involved for loans slipping into default.

Luckily, you still have options — but you’ll need to act quickly before collections resume.

Loan Rehabilitation: Your Best First Step

While it’s quicker to consolidate your loans out of default, one of the best and most impactful ways to resolve your delinquency is through Loan Rehabilitation. Here’s what it does:

- You make monthly payments based on your income.

- Your loans move out of default and into good standing.

- Your record of default gets removed from your credit report, boosting your credit score.

- It can even open doors for student loan forgiveness programs in the future.

It’s a great way to fix your loans without needing to pay everything off at once.

How Loan Rehabilitation Works

When you enroll, your monthly payment is adjusted to fit your income, sometimes as low as $5 per month!

After you make nine on-time monthly payments in a 10-month period (this means you cannot miss more than one payment), your loans are transferred to a non-default loan servicer. Unlike consolidating your loans out of default, completing loan rehabilitation erases the default record from your credit report, making it easier to qualify for things like an auto or home loan later on.

But here’s the thing: you must enroll before May 5th to avoid bigger problems.

Why Acting Quickly Matters

If you don’t act soon, here’s what could happen:

- You won’t be able to borrow additional federal student loans to return to school.

- The government could take your tax refund and apply it to your loan balance instead.

- They could garnish 15% of every paycheck you earn, including government benefits like Social Security.

- Any progress towards loan forgiveness is put on hold while in default.

- Additional fees and interest could pile up, making your student loan debt even more challenging to manage.

We’re not trying to scare you — we just want you to be ready. Loan Rehabilitation is a simple way to avoid all that and get a fresh start.

What You Should Do Next

To ensure success, you’ll want to:

- Log in to your account at Federal Student Aid’s default servicing site, myeddebt.ed.gov, and determine who currently services your loans.

- Call your servicer and tell them, “I’d like to enter my defaulted loans into a student loan rehabilitation agreement.”

- After a payment has been negotiated, sign and return the Rehabilitation Agreement that your servicer sends you.

- Make all payments in full and on time.

If you’re already a Docupop member, we’re way ahead of you! Check your email inbox for our earlier messages and give our team a quick call to get started.

Enrolling in a rehabilitation agreement may be more tedious than it appears. Collections agencies typically have stringent documentation requirements and strict hoops to jump through before being approved, not to mention the steps required if their suggested payment is still unaffordable. If you have questions, don’t wait! Reach out to us directly. Our team of experts is happy to walk you through the process, answer your questions, and help you enroll.

Frequently Asked Questions (FAQ)

What is Student Loan Rehabilitation?

Student Loan Rehabilitation is a program that lets you get out of default by making small, affordable monthly payments. After you make nine on-time payments, your loans are moved back into good standing. Your record of default is also removed from your credit report, which can make it easier to qualify for future programs like student loan forgiveness or loan consolidation.

Can I Still Get Student Loan Forgiveness After Default?

Yes, you can! Although progress towards forgiveness is paused while in default, once you complete student loan rehabilitation or successfully consolidate your loans, you may become eligible again for programs like Public Service Loan Forgiveness (PSLF) or other types of student loan forgiveness. Fixing your default is the first step to reopening these opportunities.

What Happens If I Ignore Collections on My Student Loan?

If you ignore collections on your student loans, several bad things can happen. The government can take your tax refund. They can also garnish 15% of your paycheck automatically. Plus, your student loan debt will grow with added fees and interest.

Taking action now through rehabilitation or consolidation can help you avoid these problems and regain control.

Time Is Running Out

Starting next month, collections agencies will have two options:

- Charge you the maximum amount allowed by law, without considering your income.

- Or, set up payments based on your real income — but only if you act now.

The choice is yours — but the deadline is coming fast.

If you don’t act, your options for student loan forgiveness could also shrink. Taking action now could even help you qualify for a consolidation loan later to better manage your other debts.

Let’s get you out of default, protect your paycheck, and put you back in control of your future. Call us today.

Leave a Reply